Silver has long been a sought-after metal, both as an investment and for its beauty. In recent years, silver stocks have become increasingly popular investments among investors looking to diversify their portfolios with a more resilient asset. While silver prices can be volatile in the short-term, it has historically been seen as a reliable store of value over the long term. Investing in silver stocks is an ideal way to gain exposure to this precious metal without having to purchase physical silver bars or coins. In this article we will explore what makes silver stocks attractive investments, and discuss some of the best options available on the market today.

Table of Contents

Overview of Silver Market

The silver market has experienced a lot of volatility in the past few years. Silver is an important industrial metal that is used in many applications and is also seen as a safe-haven asset due to its value as a precious metal. The silver market can be broken down into two main categories: physical silver and futures contracts.

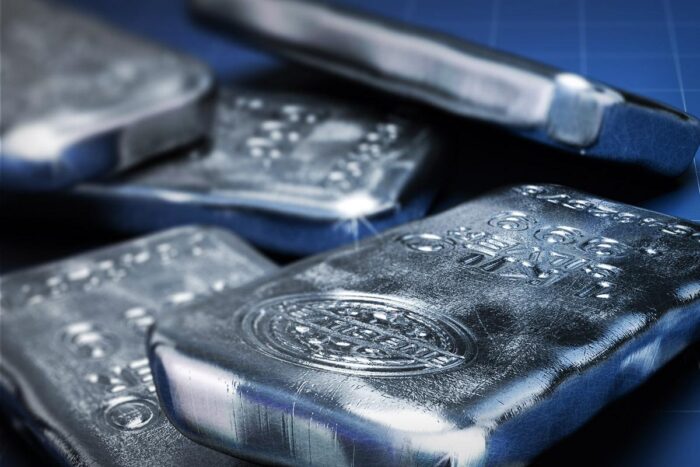

Physical silver includes coins, bars, rounds, jewelry, and other forms of bullion or collectible items. This form of ownership allows investors to take physical possession of their investment which provides them with a sense of security compared to paper investments such as stocks or bonds. Physical silver can be purchased from coin dealers, online retailers, pawn shops, and other sources. It is important for investors to do their research when purchasing physical bullion in order to ensure they are getting the best deal possible for their investment.

Futures contracts are another way for investors to trade in the silver market without taking physical possession of the asset itself. Futures contracts allow speculators to buy or sell an agreed silver price today at predetermined dates in the future at an agreed upon price which is determined by supply and demand forces on the day that contract was signed. Because these contracts are leveraged investments they involve significant risk and should only be considered by experienced traders.

Types of Silver Stocks

When you’re looking to invest in precious metals, silver can be a great option. Silver stocks come in various forms, offering investors different ways to benefit from the metal’s value. Whether you’re a beginner or experienced investor, understanding the types of silver stocks available can help you make an informed decision when investing.

Silver Mining Companies: Investing in silver mining companies is another way to gain exposure to the silver market. These companies are involved in the production, exploration, and sale of silver, and their share prices are affected by the price of silver as well as other factors such as the cost of production and supply and demand dynamics.

When investing in silver mining companies, it is important to do your research and consider a range of factors. These may include the company’s financial performance, the quality of its management team, its exploration and development plans, and its exposure to geopolitical and other risks.

One advantage of investing in silver mining companies is that they can offer the potential for significant returns. If the price of silver rises, mining companies that produce and sell the metal could see their profits increase. This could lead to higher stock prices and potential gains for investors.

However, investing in silver mining companies also comes with risks. These companies can be affected by a range of factors, including fluctuations in the price of silver, changes in production costs, and geopolitical risks such as regulatory changes or labor disputes. Investors should be aware of these risks and consider them when making investment decisions.

Overall, investing in silver mining companies can be a way to gain exposure to the silver market and potentially benefit from price movements in the metal. However, it is important to do your research and consider the risks before making any investment decisions.

Silver ETFs (Exchange Traded Funds): Silver ETFs have become an increasingly popular investment vehicle among investors who want exposure to the precious metal. These funds provide a way for investors to gain exposure to silver without the hassle of purchasing and storing physical silver. This makes them a convenient option for those who want to invest in silver but don’t want to deal with the logistics of buying and holding physical silver.

One of the advantages of silver ETFs is their liquidity. Since they are traded on stock exchanges, investors can buy and sell them just like they would with any other stock. This means that investors can quickly and easily enter and exit their positions as needed, making them a flexible investment option.

Another advantage of silver ETFs is that they offer investors a level of diversification. Instead of investing in a single silver mining company or a handful of individual silver stocks, investors can gain exposure to a range of silver holdings through an ETF. This can help to reduce the risk of a single investment going sour, as investors are not putting all their eggs in one basket.

Investors should be aware, however, that investing in silver ETFs does come with some risks. One risk is the price of silver itself. The value of a silver ETF will rise and fall along with the price of silver, so investors should be aware of the factors that can affect the price of the metal. Additionally, like any investment, silver ETFs can be subject to market fluctuations and other risks, so it is important to do your research and understand the potential risks before investing.

Factors to Consider When Choosing Silver Stocks

Investing in silver stocks can be a profitable way to diversify your portfolio and benefit from the potential for returns. As with any investment, it’s important to do your research before investing in any silver stock. Here are some factors you should consider when choosing silver stocks.

- Track Record: Before investing in any silver stock, it’s important to look at its past performance and track record of success or failure. Doing this will help you determine if the company is a good investment or not. You should also look at the company’s financial statements and recent news reports to get an idea of how well they’re doing financially. Additionally, check out analyst ratings for each stock so you can gauge whether experts think it’s a good buy or not.

- Diversification: Diversifying your investments is key when it comes to reducing risk and maximizing potential profits over time. Investing in several different types of silver stocks can help diversify your portfolio and reduce risk while providing exposure to different markets with different risks profiles as well as different levels of growth potential depending on their business models and strategies employed by their management team.

Top Silver Stocks to Invest In

Silver stocks have been on the rise over the past few years, due to rising silver prices and increased demand for investment. Silver stocks are attractive investments for those looking for a relatively safe and stable way to diversify their portfolios.

Investing in silver stocks can be a great way to make money from the metals market, as well as a way to hedge against inflation. Silver is more volatile than gold and often provides higher returns than gold in bull markets. So if you’re looking to invest in silver stocks, here are some of the top ones right now:

First Majestic Silver Corporation (TSX: FR): First Majestic is one of the largest primary silver producers in Mexico. The company has several producing mines that generate consistent cash flow and provide investors with an attractive dividend yield of 1%. First Majestic also has strong growth prospects due to its large land holdings and its ability to use technology to enhance production efficiencies throughout its mining operations.

Wheaton Precious Metals Corp (TSX: WPM): Wheaton Precious Metals Corp (TSX: WPM) is a Canadian company that specializes in precious metals streaming and royalty financing. The company provides financing to mining companies in exchange for the right to purchase a portion of their future precious metals production at a fixed price.

Wheaton Precious Metals has a diversified portfolio of assets, with exposure to several different commodities including gold, silver, palladium, platinum, copper, and cobalt. The company’s streaming and royalty agreements provide it with a reliable source of precious metals production and cash flow, without the risks and costs associated with owning and operating mines.

Wheaton Precious Metals has a proven track record of success, with a strong balance sheet and a history of consistently increasing dividends. The company’s focus on precious metals streaming and royalty financing allows it to provide investors with exposure to the mining industry and precious metals markets, while minimizing risks and maximizing returns. As a result, Wheaton Precious Metals is a popular choice among investors looking for exposure to the precious metals sector.

Final Thoughts

Final thoughts are the last thing a person wants to think about when it comes to any type of situation. It’s the feeling that everything has been said, done and thought about, so there is nothing else to do but contemplate the results. Final thoughts can be a scary prospect, as they represent closure and finality in a situation. However, they can also be an opportunity for growth and reflection on what has happened thus far.

When faced with final thoughts, it’s important to take stock of the entire situation before making any decisions. Take some time to think through all the facts and details of what happened over time – consider both successes and failures – so that you have a complete picture before coming up with your resolution or action plan. Ask yourself questions like “What could I have done better?” or “How did my actions contribute to this outcome?” This will help give you clarity on how best to move forward in similar situations in the future.