Retirement is something that we all look forward to and target as a well-deserved rest after a life of hard work. The key to getting the most from it though is having the stability to not only manage financially but also enjoy yourself. With this in mind, many people will look to invest some of their spare money in various assets to achieve stability when retired.

One popular choice with this in mind is savings bonds. But what are they, how can you put money into them and why are they the answer to a stable retirement?

Table of Contents

What are savings bonds and how can you invest in them?

In simple terms, savings bonds allow individual investors to loan money to a national government, which is then repaid at the end of the loan term with interest on top. US Treasury Bonds are a good example of a popular, secure bond to put money into for retirement.

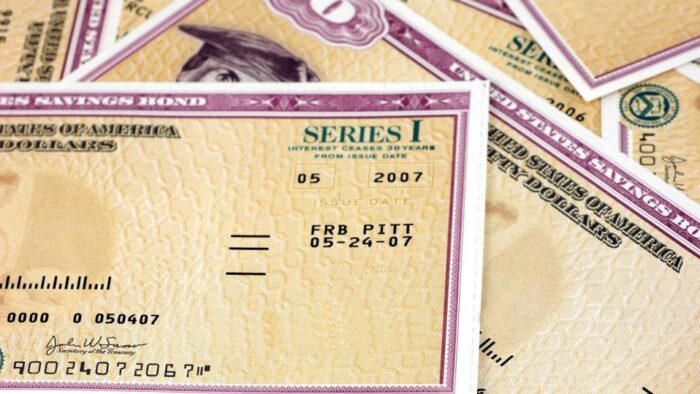

Investing in savings bonds is easier than ever in modern life and this is thanks to the digital transformation recently seen in the sector. While putting your money into this asset once involved buying paper bond certificates, it is now almost exclusively done online.

This not only makes it much more convenient but also much safer for traders. Bonds which are purchased online are stored electronically and this is more secure than paper bonds which could be lost or stolen.

Are savings bonds the key to a stable retirement?

If you are due to retire soon or are thinking about it well in advance, investing some money in order to receive a decent income is wise. This helps you to top up any pensions you might have to live on and ensure you have enough money coming into the household to enjoy your later years. If you also top this up with some of the best ways to make money when retired, then you should be all set.

While there are many assets you could invest in, bonds are often seen as the best in terms of providing the financial stability you need in retirement. But why is this the case?

1. Bonds are low risk

If you are looking for stability look no further than investment bonds, as they are a low-risk investment everyone is looking for. Bonds are generally viewed in this way and are certainly less volatile than investments such as stocks.

As a result, bonds include a sense of stability and tend not to experience wild fluctuations in the returns they offer. This makes them a more stable investment for retirement and one that is easier to predict in terms of the return you should get. As bonds are loans to national governments which represent a very low credit risk, you also have the peace of mind that you are almost guaranteed to get your initial capital outlay back at least.

2. Regular income stream

Financial stability in retirement relies on a reliable stream of income providing the cash you need. Savings bonds are a good choice in this regard because they pay interest regularly and give investors a steady, predictable income over time.

In addition to this, you also know how much you invested initially and how much is due back when the bond matures. This makes investing in this asset hassle-free and allows you to enjoy a stable retirement.

3. Savings on tax

Although not all bonds are tax-free, some fall into this bracket and provide a tax-free income to investors who are retired. As a result, this provides an extra level of predictability when trading them, as you do not have the taxman eating into your expected profits.

Investing in non-taxed bonds is also an easier way to achieve financial stability in retirement and less hassle. This is because you do not have to worry about filling in paperwork to report any income made on non-taxable bonds to the taxman!

4. Bonds have been around for a long time

Another point that highlights how investing in this asset can lead to a stable retirement is how long bonds have been around. The history behind them means they are a trusted, legitimate investment that is not going anywhere soon.

This level of stability is perfect for retirement and means you can put money into them for the long term with full confidence. When you also factor in that bonds are easy to understand and do not need you to spend your retirement managing your investment in them each day, their appeal becomes even clearer.

Tips for Maximizing the Benefits of Savings Bonds in Retirement

To maximize the benefits of savings bonds in retirement, investors should consider several tips. One tip is to invest in bonds with higher interest rates to increase the overall return on investment. Investors should also be aware of the bond’s maturity date and plan accordingly to avoid penalties for early withdrawal.

Another tip is to use savings bonds as a part of a diversified retirement portfolio to minimize risk and maximize returns. It’s also important to keep track of the bond’s interest rate and adjust the investment strategy accordingly. Lastly, investors should regularly review their retirement portfolio and make any necessary adjustments to ensure their savings bonds are still meeting their financial goals.

Savings bonds are a stable retirement investment

If you are thinking of investing some spare money as a way to achieve a more stable retirement, savings bonds represent a wise choice. This comes down to the factors we have looked at above and the ease in which you can now trade this asset online.