Whenever you need to take out a credit or loan, you must be aware of the rights and obligations you have. This also applies to car loans, but also to all other types of loans that you need.

What you need to know is that lenders are interested in your credit score and want to make sure that you pay your debt installments on time. They are least interested in whether you are honest and friendly because in such situations it is about fulfilling the obligations that arose from the loan agreement.

Therefore, in general, to apply for a car loan you need:

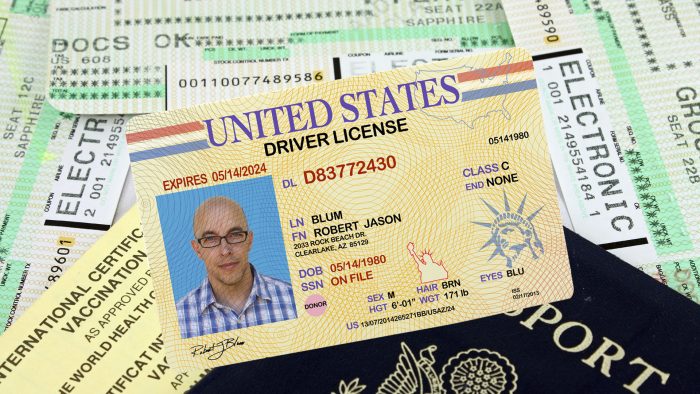

- Personal identification documents

- Personal data

- Proof of paid wages i.e. paystub

- Proof of assets and liabilities

Always provide correct information. Renew your personal documents before entering into such debt situations. Lenders need your full name, age, and proof of residency or citizenship. You are also required to have a valid driver’s license.

If you have dependents, please indicate this in your application. It can be children, but also older relatives who cannot take care of themselves.

In this article, we will explain the importance of each document that the lender requires from you.

Table of Contents

1. Proof of identity

Your identity is crucial in the collection of data during car loan approval. With the help of the driver’s license, you prove that you are an active driver. Under certain conditions, the lender can prove your identity without asking you for all those documents.

But you must be prepared, whether you are taking out a personal vehicle loan or buying a car for your business.

2. Proof of income

This document is important because it proves your creditworthiness, as well as your previous credit rating. This is useful for lenders to know if you are able to regularly repay your debt before they approve the loan.

The document called a paystub contains all the necessary information. Lenders can request a report for the last 12 months, but also consider a longer period.

If you are self-employed, you can generate such a document yourself and prove your creditworthiness. Don’t forget to bring proof of taxes paid. All documents must be authentic to the actual situation.

If you are taking money for alimony, support, rental income, or on any basis, bring those documents as well. All those reports can improve your credit rating and make it easier for you to get a loan to buy a new car.

3. Credit history (if you have)

Lenders may ask for your Social Security number so they can get a clear picture of your credit history. With this number, they get access to your previous credit history and whether you regularly pay your debts. This is an important aspect, which can influence the final decision of the borrower.

The credit history may also contain sensitive data, which is not relevant to what you are looking for now. However, for lenders, only the last six months, a year, or a period of three to five years may be important. It all depends on the amount of car loan you are asking from them.

4. Proof of residency or citizenship

In the US, many lenders will ask you for proof that you are a citizen or that you have a residence permit there. A simple document verified by the government is usually enough for lenders to approve a car loan.

But you may be asked to provide additional evidence, such as a house or apartment lease, paid bills, residence permit, employment contract, bank statement, or proof of taxes paid.

These are additional requirements so that the lender can confirm your status in the country and, based on that, approve you to take out a loan.

5. Data on the current vehicle and the car you want to buy

Lenders need to know the exact price of the vehicle, as well as the technical characteristics, so they can estimate how much money they can approve for you. Therefore, regardless of whether you buy from a dealership, reseller, or private seller, you must always have proof of the vehicle’s price, vehicle identification number, and information about the manufacturer, model, and year of manufacture. This also applies to used cars, so you should include the miles traveled and all possible information about repairs and changed parts.

Data on the current vehicle is required to be able to transfer ownership and use the same registrations, but for another car.

6. Method of payment

Whether you pay in cash, by transaction, with borrowed money, or in installments, you must advise how you plan to complete the payment. This will help you personally to plan your expenses more easily.

Of course, you must be sure that you can pay the installments in the agreed amount. It often happens that the user agrees to pay, for example, $2,000 per month, and the bank limits it to a smaller amount, which is not pleasant at all.

That is why you should submit a payment method statement and avoid such technical inconveniences.

Important details about car loans

These loans are valid only for the person requesting them and only for the vehicle specified in the documents. Changes are possible, but all this brings additional costs. Therefore, be sure that the loan remains in your name until it is fully returned to the lender. Do the same for the car.

In case of inability to pay further, the lender can seize your car or give you a transitional period to find a new job and cover your debts.

In case of death of the credit holder, the debt passes to other family members or to the signatories. However, these are situations that we cannot plan for in advance and are dealt with on an ongoing basis as they occur.

Finally, we only have to advise you to always carry the necessary documentation and leave nothing to chance. Although it is not a seriously large amount of money, a car loan is your responsibility and you certainly do not want to make a serious mistake.